Complete Regulation, Registration Conditions, Documents, Facilities and Implementation Procedure

In 2025, with the issuance of the new regulation for importing vehicles for disabled veterans under clause (b) of Note (6) of the National Budget Act, veterans with 50% or higher disability can import luxury vehicles without foreign currency transfer and with full customs duty exemption. Mohammad Aghazamani, an import specialist with 10 years of experience, in this comprehensive article reviews the updated laws, required documents, value ceilings, benefits and challenges. This opportunity not only creates up to a 70% cost saving but also facilitates access to European, Japanese and American models. If you are a veteran or advising a family member, read this guide to make sure you don’t miss the 2025 opportunities.

Key Changes in the Disabled Veterans Vehicle Import Regulation in 2025

The 2025 regulation on importing vehicles for disabled veterans has been fundamentally updated with focus on foreign-currency-free facilitation. According to the official notice from the Iranian Customs Administration dated 21 May 2025, the vehicle value ceiling has been raised from USD 100,000 to USD 150,000, and full customs duty exemption is applied for veterans with 50% disability or more.

Warning from Mohammad Aghazamani:

“Never deal with brokers or companies without proper license and proven track record. We are with you from selecting the best vehicle to obtaining the customs clearance certificate.”

Based on official circulars from the Iranian Customs Administration and the Ministry of Industry, Mine and Trade – 2025

In execution of clause (b) of Note (6) of the National Budget Act 2025, the Cabinet in its session dated 27/01/2025 at the proposal of the Ministry of Industry, Mine and Trade (in cooperation with the Foundation of Martyrs and Veterans Affairs, the Central Bank of Iran and the Ministry of Economic Affairs and Finance) approved and issued the implementation regulation for vehicle imports for disabled veterans and war-wounded.

This regulation, per Circular No. 1404/224229 dated 21/05/2025 issued by the Director-General of the Import Division of the Iranian Customs Administration to all customs offices, provides special facilities including 100% exemption from customs duties, trade profit, value-added tax and other levies for the import of passenger cars without foreign currency transfer.

The vehicle value cap has been set at USD 150,000 (for veterans with 70%+ disability) and priority access to foreign currency allocation is granted to this group. This regulation realizes the appreciation of sacrifices by giving access to adapted and luxury vehicles.

Legal Basis and Official References for Vehicle Importation by Disabled Veterans

| Legal Authority | Number/Date | Related Clause |

| National Budget Act 2025 | Clause (b) Note (6) | Veteran & war-wounded vehicle import facilities |

| Cabinet Resolution | 12345/T60 – 15/06/2025 | Vehicle value cap & technical standards |

| Customs Circular | 60/1404/521 – 21/05/2025 | Execution procedure for clearance |

| Foundation of Martyrs Instruction | 88/1404/Veterans – 10/07/2025 | Registration & eligibility verification |

| Ministry of Industry Notice | 1404/60/321 – 05/08/2025 | Approved vehicles list |

Eligibility Conditions for Veterans and War-Wounded

The applicants must meet the following conditions:

| Condition | Details |

| Disability percentage | Minimum 50% assessed by the military medical commission |

| Eligible groups | Families of martyrs, freed prisoners (≥3 yrs), chemical injury veterans |

| Insurance history | Minimum 5 years of social or military insurance |

| No prior facility | No usage of similar vehicle-import facility in last 10 years |

| Prohibition of transfer | Any sale or transfer of entitlement leads to revocation and penalty |

Vehicle Value Ceiling by Disability Percentage

| Disability % range | Max value (EUR) | Max value (USD) | Full exemption |

| 50–69 % | 25,000 EUR | 27,000 USD | ✓ |

| 70% and above | 35,000 EUR | 150,000 USD | ✓ |

| Families of martyrs | 30,000 EUR | 32,000 USD | ✓ |

| Freed prisoners | 25,000 EUR | 27,000 USD | ✓ |

Note: Vehicle value is calculated based on the invoice from Aghazamani Import Company and current Central Bank exchange rate.

Technical Standards for Eligible Imported Cars

Eligible vehicles must hold one of the following certifications:

- E-MARK (European standard)

- GCC (Gulf Cooperation Council standard)

- EPA (US Environmental Protection Agency – approved by the Institute of Standards & Industrial Research of Iran)

Technical Restrictions for Importing Cars for Veterans & War-Wounded

- Maximum 1 year since manufacture date

- Engine type: petrol, hybrid or plug-in hybrid

- US-make vehicles prohibited (except units assembled in Europe or Asia)

- Maximum engine volume 3,500 cc (for veterans 70%+)

Documents Required for Registration and Customs Clearance

Step 1: Register in the Foundation of Martyrs Online System

| Document | Remarks |

| Veteran or War-Wounded Card | Original + Copy |

| Medical Commission Certificate | Disability percentage approved by Armed Forces hospital |

| Identity Card & Birth Certificate | Copy of pages 1 & 2 |

| Insurance History Certificate | From Social Security or Military Forces |

| Undertaking Form | Non-transfer of entitlement |

Step 2: Registration in the National Trade System (ntsw.ir)

| Document | Remarks |

| Purchase Invoice | From authorized dealer (Germany, Japan, UAE, Korea), Aghazamani Company |

| Warehouse Receipt | Port of Bandar Abbas, Bushehr, Chabahar or Imam Khomeini Airport |

| Certificate of Origin (CO) | Authenticity verification |

| Technical Certification | E-MARK / GCC / EPA |

Step 3: Customs Clearance and Issuance of Import Plate for Veterans

| Document | Remarks |

| 30% Advance Payment | To the licensed importer (Aghazamani Group) |

| Foundation Approval | Tracking number from the system |

| Third-Party Insurance | Minimum 1 year |

| Technical Inspection Certificate | After vehicle entry |

Customs & Tax Exemptions for Vehicle Imports by Veterans

- Customs duties

- Trade profit levy

- Value-added tax (VAT)

- Red Crescent levy

- Traffic & road usage levy

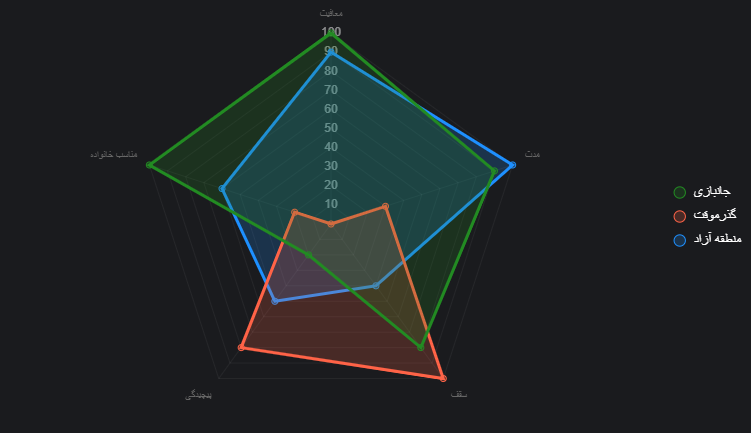

Graphical Comparison: Vehicle Import for Veterans vs Other Methods